This article was originally published on the Strategic Innovation in the Age of Decentralization blog, February 10th, 2020.

On March 16 2018, L’Oréal announced their acquisition of Modiface, an augmented reality beauty startup based in Toronto. Using artificial intelligence, the company’s software tracks your face and simulates different makeup or hair styles. L’Oréal Professionnel’s Style My Hair App is a great example of this technology and the use case is quite simple:

Two key customer concerns during a colour service is “will a new hair colour suit me” and “will my hairdresser understand me”. The app creates a realistic visual of the result, alleviating the client’s stress while providing the colourist with an accurate image of what is desired.

At the time, Modiface was providing brands across companies like Sephora, Unilever, Estée Lauder and Coty with similar functions. However with the acquisition, L’Oréal gained exclusive rights to all this cool tech; the world’s largest cosmetics company will take its first major step towards merging the beauty and technology industries, cementing its place as the leader of a new BeautyTech world.

A year later, at VivaTech 2019, a prominent technology conference in Paris dedicated to innovation, L’Oréal’s CEO Jean-Paul Agon and CDO Lubomira Rochet doubled down on customization and technology with products like SkinCeuticals Custom D.O.S.E and Lancôme’s Le Teint Particulier.

Both products provide incredible personalization but require a consultation before getting your very own formulation. For Custom D.O.S.E, you walk into your dermatologist’s office, fill out a questionnaire, get a skin analysis, and out pops a serum made specifically for you. Le Teint Particulier uses a similar model and is available at retail locations, where a beauty expert will help calibrate an exact texture and colour match for your next foundation. These are not the only products using technology to change the way we consume beauty: Optune by Shiseido, Fusio-Dose by Kérastase, and Color&Co by L’Oréal all have similar features.

Although all these brands are focused on meeting an individual’s specific needs, the question is whether their personalized offerings can create enough value to increase consumers’ willingness to pay. In July 2005, psychologist Barry Schwartz gave a Ted Talk named The Paradox of Choice. He argued that consumers feel paralyzed when faced with too many options, ultimately leading to dissatisfaction. By using technology, brands are betting that they can make the decision for us and command a premium over traditional products. However, there is also the possibility that tech will create even more choice thus increasing the friction of making a purchase. After all, for most of these products, you need to trust some unknown AI to make the correct assessment and prescribe a unique product out of thousands of possibilities; Le Teint Particulier, for example, can produce 72,000 different combinations of foundation.

L’Oréal has been selling products for 110 years, but we need to start selling services. I believe that the company that just sells products will not be successful.

Stéphane Bérubé, L’Oréal CMO, Western Europe

According to Euromonitor, the worldwide beauty market set to reach $863 billion (USD) by 2024 representing a compounded annual growth rate of over 7% and innovation will play an important role in getting us there. For those familiar with business strategy, BeautyTech has all the elements characterizing an architectural innovation, combining both new competencies and a new business model. Just like Netflix changed the way we consume television, so will new digitally native brands transform the way we consume beauty. With this in mind, one can expect more technological investments by large beauty conglomerates as they seek to close their digital gap. Unfortunately, some legacy brands, either from hubris or ignorance, will fail to make the adjustments necessary to survive. In 2018, Stéphane Bérubé, L’Oréal’s Chief Marketing Officer for Western Europe, told Festival of Marketing that a company that just sells products will not be successful. By offering new technology-enabled services directly to consumers, a traditional CPG will be able to increase brand loyalty and collect valuable insights from its consumers, which, in addition to architectural innovation, will drive more accurate and effective routine innovation.

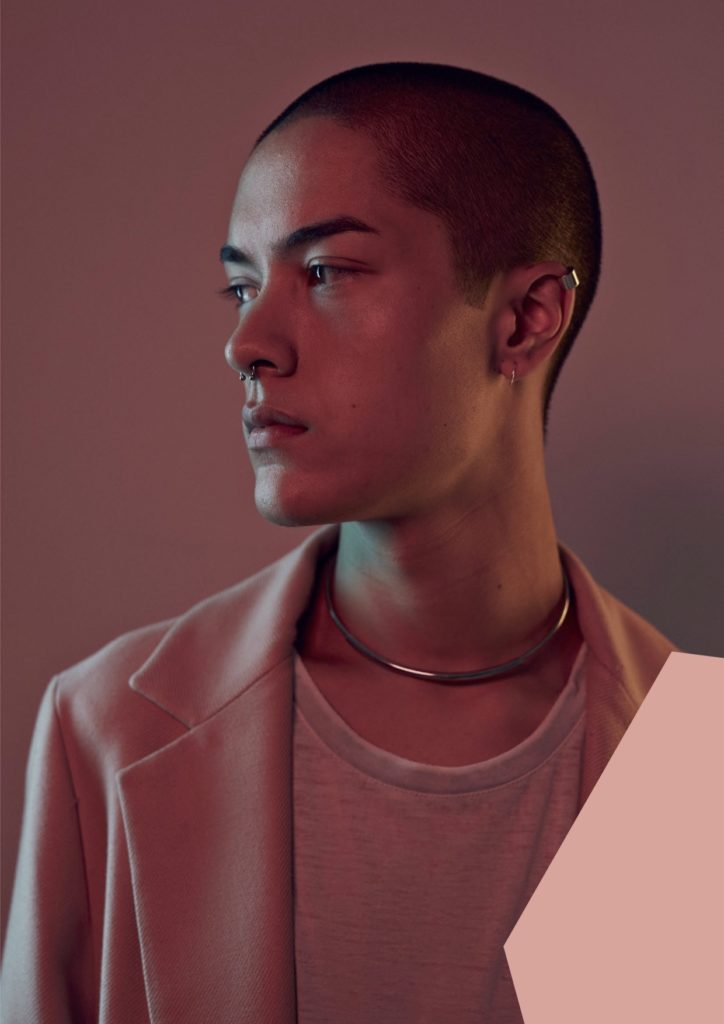

Look no further than Gen Z for an indication of the beauty industry’s future. In their latest whitepaper, Gen Z: Building New Beauty, WGSN’s Beauty & Insight team describe this generation as having minimal distinction between the physical and digital worlds. These phygital consumers are self-educated, racially inclusive and gender fluid, which is why they, more than any other generation, are asking for ultra-personalized and technology-enabled experiences. Furthermore, an average Gen Zer uses social media constantly, watches over 50 videos a day and is more comfortable connecting with someone online instead of in person, making at-home beauty that much more important.

This past January, at CES 2020 in Las Vegas, L’Oréal unveiled Perso, an AI-powered device for personalized skincare, lipstick and foundation, finally bringing customization into your home. Using its face-scanning Modiface technology and combining that information with environmental factors like your location’s UV index or temperature, it produces the perfect mix of product just for you. It also gets smarter over time, has the ability to suggest a lipstick colour based on your outfit and allows for portability with a cool, detachable, mirrored lid. Perso even comes with an automatic refill process that automatically ships the NFC cartridges it uses in its formula when they are running low.

In brief, it is an exciting time to be part of this dynamic industry; technologies like 3D printing, artificial intelligence and augmented reality have slowly started making an appearance in mainstream markets but are still quite niche. As adoption increases, driven by the Gen Z demographic, new brands will be created, old brands will transform or disappear, creating an entirely new decentralized customer experience focused on personalization. The BeautyTech revolution has begun!